Comments

EV MANDATE - A look inside the factory that assembles Ford’s F-150 electric pickup. As the industry invests $40 billion in new US electric car plants, the rapid transformation raises labor and supply chain issues. Automaker says “we’re all-in.”

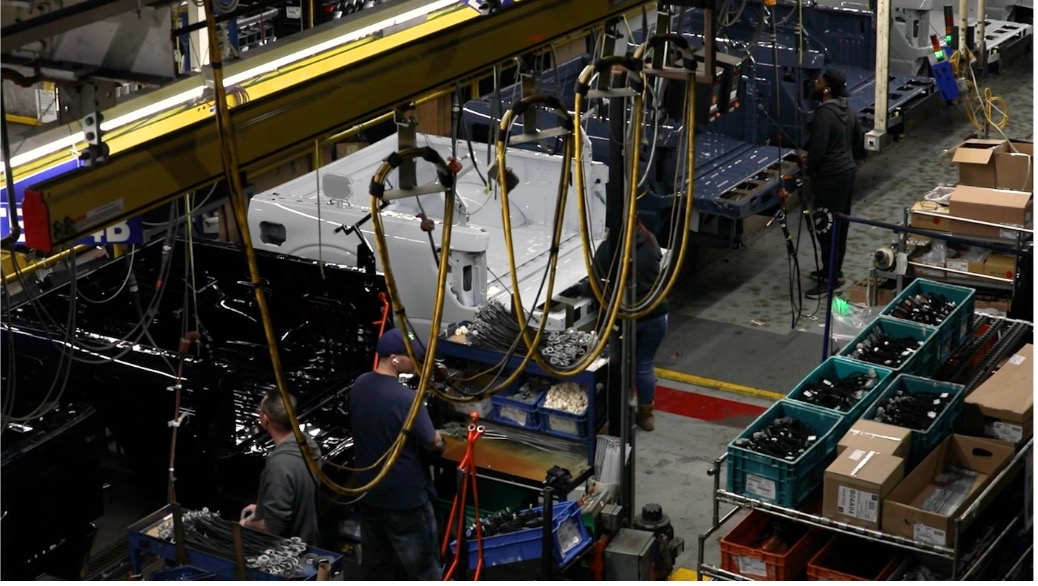

Amid the clank and clatter of the factory floor in Dearborn, Michigan, self-moving robotic vehicles transport the 1,600-pound batteries that power Ford’s flagship electric pickup truck to workers in various stations, who rush to bolt them to other parts.

After workers inspect each battery, the robot moves it along a track to the next station, then wedges itself between two idling robotic arms. One arm is overhead, dangling the 2023 F-150 Lightning’s chassis, while the other swiftly moves to pick up the massive battery and attach it to the chassis.

Assisted by more robots, workers quickly assemble the remaining parts: the aluminum frame, tires, cab and truck bed. Then the completed pickup truck — which has a long wait list of potential buyers — undergoes a final round of inspections and testing here at Ford’s Rouge Electric Vehicle Center.

From Michigan to Georgia to the Bay Area to overseas, a new age of car manufacturing has arrived, spurred by California’s landmark mandate to end new sales of gasoline-powered cars in a dozen years. Already the transition to electric vehicles is exposing automakers to myriad challenges as they rush to ramp up production.

“Demand for electric cars is rising even faster than ever before,” said Darren Palmer, Ford’s vice president of electric vehicle programs. “It’s changed the way we work, it’s changed everything.”

The industry is grappling with supply chain constraints, fierce competition for crucial raw battery materials, and a rush to start producing cheaper, U.S.-made batteries — while also getting new assembly plants up and running in time to meet California’s ambitious timeline. At the same time, the autoworker union has raised fears about job security and workplace safety during the industry’s rapid transformation.

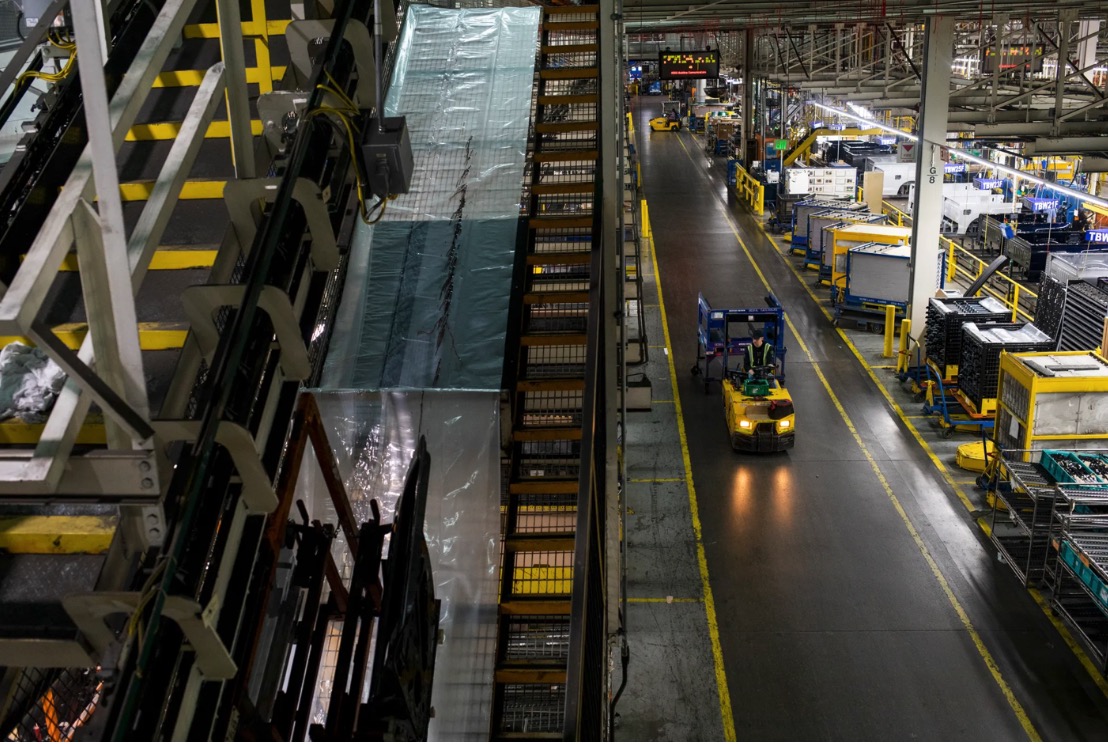

At Ford’s River Rouge complex in Michigan, factory workers build electric and gas-powered F-150 pickup trucks on assembly lines. Photo by Emily Elconin for CalMatters

Forty-four major factories already produce electric vehicles in the United States, and several automakers, including Toyota, Hyundai and Ford, are now building massive new factories to assemble electric cars, as well as new battery manufacturing plants. The investment in new U.S. factories: more than $40 billion.

Tesla has long-dominated the market, selling more than a million cars last year. Still, some companies, particularly Toyota — which sold only a few hundred all-electric cars in the U.S. last year and recalled them for faulty wheels — have been resistant and slow to make the change, industry experts say. Instead, Toyota remains focused on its hybrids instead.

“Demand for electric cars is rising even faster than ever before. It’s changed the way we work, it’s changed everything.”

Darren Palmer, Ford vice president of electric vehicle programsnone

At Ford, Palmer says they’re up to the task. By the end of this year, the automaker plans to produce at least 150,000 F-150 Lightnings a year — more than four times the number the company initially planned.

Facing California’s mandate, “we know that we will move to all-electric eventually — we’re all-in,” Palmer said, adding that “there’s a whole load of states that are all following California.”

“A challenge for a company like ours,” he said, “is how do you manage that transition?”

Revamping assembly lines — and the workforce

As one of the Big Three U.S. automakers, the Ford Motor Company has been a leader in the auto market since the company was founded more than a century ago, producing many of the gas-guzzling cars Americans love to drive. But California is now forcing Ford and the rest of the global auto industry to move quickly to zero-emission models.

Vehicles account for about half of all greenhouse gas emissions in California, making them the state’s single largest source warming the planet and polluting the air with smog and soot.

Adopted by the Air Resources Board last August, California’s mandate requires 35% of new 2026 cars sold in the state to be zero-emissions — almost double the current sales — then ramping up to 68% in 2030 until reaching 100% in 2035.

California drives the U.S. auto market — one out of every 10 cars is sold there — and at least 17 other states have pledged to enact California’s rules. Putting even more pressure on automakers, the Biden administration last month followed California’s lead in proposing its own stringent measures to scale up production of electric vehicles nationwide.

Darren Palmer, Ford’s vice president of electric vehicle programs, says the company is “all-in” when it comes to meeting California’s mandate to phase out gasoline cars. “It’s changed the way we work, it’s changed everything,” he said. Photo by Emily Elconin for CalMatters

Automakers will have to sell almost 12 million electric cars in California by 2035. Only about 838,000 electric vehicles were on California’s roads in 2021.

Such a rapid transformation of the giant industry is unprecedented.

“We just don’t have the production capacity today to satisfy that potential need in the future,” said Erich Muehlegger, a UC Davis professor of economics who analyzes electric vehicle market trends. “Automakers are in the process of developing that, but it’s not something that can be done overnight.”

During California’s rulemaking last year, the auto industry pushed for looser requirements, calling them “too aggressive” and “extremely challenging.” But now, as the state’s deadlines loom, many automakers are focusing their engineering skills and investments on achieving them.

“We just don’t have the production capacity today to satisfy that potential need in the future…It’s not something that can be done overnight.”

Erich Muehlegger, UC Davis professor of economics none

State air-quality officials say they are confident that manufacturers can scale up to meet the deadlines. California is already two years ahead of schedule in achieving its 2025 target of selling 1.5 million zero-emission vehicles. About 19% of new cars in California last year were emissions-free.

“Now we are moving all the way to zero,” said Air Resources Board Chair Liane Randolph. “We’re very optimistic that we are going to see dramatically increasing deployment going forward.”

Ford announced a surge in its investments in electric vehicle production: about $50 billion globally for electric vehicles and battery materials through 2026 — up from $30 billion — with a goal of producing 2 million electric vehicles.

But to manufacture electric cars and pickups, Ford has to totally revamp its assembly lines and retrain its workforce. It’s a vastly different process than building a truck with an internal combustion engine. The all-electric version of the Ford F-150 pickup truck has far fewer parts than its gasoline-powered counterpart: no spark plugs, pistons, fuel tank, oil filter, multi-speed transmission, timing belt, muffler or catalytic converter — to mention only a few. Internal combustion engines have thousands of parts while electric power systems have only six main components.

Watch workers assemble Ford’s popular F-150 Lightning pickup at the company’s Rouge Electric Vehicle Center in Dearborn, Michigan.

The union representing General Motors, Ford and Chrysler workers says the transition could threaten job security. United Auto Workers estimated in 2018 that electrification could result in a loss of about 35,000 jobs among its 400,000 members.

For instance, the traditional, gas-powered model of the F-150 is assembled by 4,400 workers at Ford’s Dearborn factory, while the all-electric version, assembled next door, takes only about one-sixth of the workforce, 750 employees.

Laura Dickerson, director of United Auto Workers Region 1 in Michigan, said maintaining good-paying, middle class jobs will be critical to ensuring a successful transition to electric vehicles. Dickerson said workers who build cars don’t enter the industry because they’re passionate about gas-powered engines or electric vehicles — they do it because the jobs provide financial security.

“Moving into the future, we just need to make sure that we protect the work because those are environmentally friendly jobs,” she said.

Workers “don’t know if they’ll get burnt by (EV materials)…They don’t know if something else will develop, because all of this is new. There are a lot of unknowns.”

Laura Dickerson, United Auto Workers none

Ford representatives declined to address questions about employee retention or layoffs, but said the company would be hiring additional employees as it expands its electric vehicle center. Ford will reassign an 800-person crew this fall, moving them from the plant that builds traditional F-150s, and plans to hire 300 new employees this year. In all, the F-150 Lightning plant will employ about 1,800.

The struggle to maintain good-paying jobs while producing electric vehicles has already led to clashes between some automakers and their employees. At a GM plant in 2019, nearly 50,000 unionized employees went on strike during contract negotiations when the automaker announced plans to shut down some plants that produce gas-powered cars and shift to electric car production.

Volkswagen’s top executive also predicted job losses, saying building an electric car takes “30% less effort” than building an internal combustion engine.

(Nadia Lopez covers environmental policy issues. Before joining CalMatters she covered Latino communities in the San Joaquin Valley for The Fresno Bee and reported from city hall for San José Spotlight. She's a native of Chula Vista and a graduate of San Francisco State University. This article was first published in CalMatters.org.)