CommentsPLANNING WATCH - Because Planning Watch columns present such a grim picture of life and City Hall politics in Los Angeles, I was pleasantly surprised to receive information on a proposed local ballot initiative that addresses some root causes of homelessness.

While not perfect, I am reminded of the saying: Don’t let the perfect be the enemy of the good. In this case the ballot initiative is infinitely better than the State and local real estate scams I often debunk.

The proposed Los Angeles ballot initiative would create a local Real Estate Transfer Tax and administrative mechanism. It is modeled after the State of California’s 0.11 percent (.0011) Documentary Transfer Tax. If approved by a majority of LA voters, the local Real Estate Transfer Tax would generate $800 million per year, which would be solely devoted to local low income housing programs. Unlike Los Angeles County Measure HHH, which has one-time funding, a local Real Estate Transfer Tax would establish a permanent financial pipeline to address LA’s housing crisis. The initiative’s sponsors estimate that over a 10 year period the local Real Estate Transfer Tax would generate $8 billion in municipal revenue. Five percent would be devoted to administration, leaving the remaining 95 percent for low-income housing programs.

The precedent for this new local tax is the 0.11 percent (.0011) fee that the State of California charges for the transfer of real estate documents. For example, the State collects $1,100 on the sale of a million dollar house. A local Real Estate Transaction Tax, such as the one that already exists in Alameda County, would be in addition to the State’s Documentary Transfer Tax. While the LA initiative is not yet finalized, it would probably be similar to the State’s and Alameda County’s fees, meaning a million dollar house would be charged an additional 0.11 percent (.0011) when it is sold. Together, the two taxes would amount to 0.22 percent (.0022) of the selling price.

This is what this permanent housing revenue stream intends to accomplish, especially the preservation of Naturally Occurring Affordable Housing (NOAH).

- 20 percent for tax credits on the construction of multifamily affordable rental

- 20 percent for new affordable housing.

- 15 percent for the rehabilitation of existing affordable housing.

- 10 percent for innovative production strategies, such as hotel conversions.

- 5 percent for project or tenant-based rental subsidies.

- 5 percent for short-term rental assistance.

- 10 percent for the highly rent burdened (e.g., persons with disabilities).

- 10 percent for eviction defense.

- 2 percent for tenant outreach and education.

- 3 percent for anti-tenant harassment enforcement.

What is the difference between this proposal and the recent up-zoning legislation passed by the State Legislature, such as Senate Bills 9 and 10, and their local counterparts, LA’s 2021-2029 Housing Element, up-zoning ordinances appended to LA's Community Plan Updates, and de facto zone variances for developers who build housing within a half-mile of mass transit?

- This initiative could dampen LA’s current real estate boomlets by taxing sales, in contrast to the State and local programs, which further inflate these housing bubbles.

- The initiative addresses a root cause of the housing crisis, the lack of affordable housing, not an alleged housing shortage that conflates abundant luxury and market housing with missing low-priced housing.

- The initiative assumes that transit-adjacent apartments must be affordable to become transit-oriented. If not, their upscale tenants will continue to own and drive cars, only resorting to mass transit in emergencies.

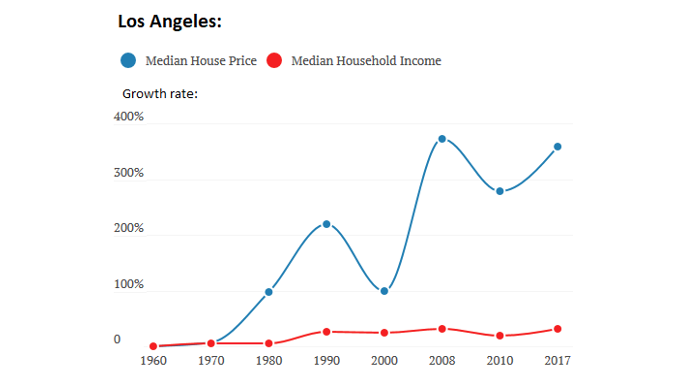

- The initiative emphasizes that the homeless and overcrowded have been priced out of existing housing because of declining wages and rising housing prices, not a housing shortage caused by legacy zoning laws. The basis for this argument is that LA’s housing prices have risen faster than wages since the 1970’s. Since this is the same time period when the Federal government eliminated its public housing programs, these trends may be linked.

- The preservation of existing affordable housing is part of the solution, in sharp contrast to the current practice of demolishing older houses to make way for new, in-fill market-rate apartments and McMansions.

What the Real Estate Transfer Tax Initiative movement still needs to act on.

- The restoration of HUD and CRA public housing programs is imperative. A local Real Estate Transfer Tax cannot fill the enormous gap created by the termination of Federal housing programs beginning in the 1970’s and the dissolution of California redevelopment agencies in 2012.

- Reducing speculation in local real estate by private equity companies that buy and hold buildings, condos, and houses as speculative investments.

- New low cost housing must be built and operated by public agencies, such as the Los Angeles Housing Authority, not contracted out to private developers.

- Indexing the minimum wage to inflation. The Transfer Tax is a step in the right direction, but in itself, is not enough to reverse increasing economic inequality, a major cause of the housing crisis.

(Dick Platkin is a former Los Angeles city planner who reports on local planning issues for CityWatchLA. He serves on the board of United Neighborhoods for Los Angeles (UN4LA) and co-chairs the new Greater Fairfax Residents Association. Previous Planning Watch columns are available at the CityWatchLA archives. Please send questions and corrections to [email protected] .)